VERTIMASS TECHNOLOGY SOLUTION

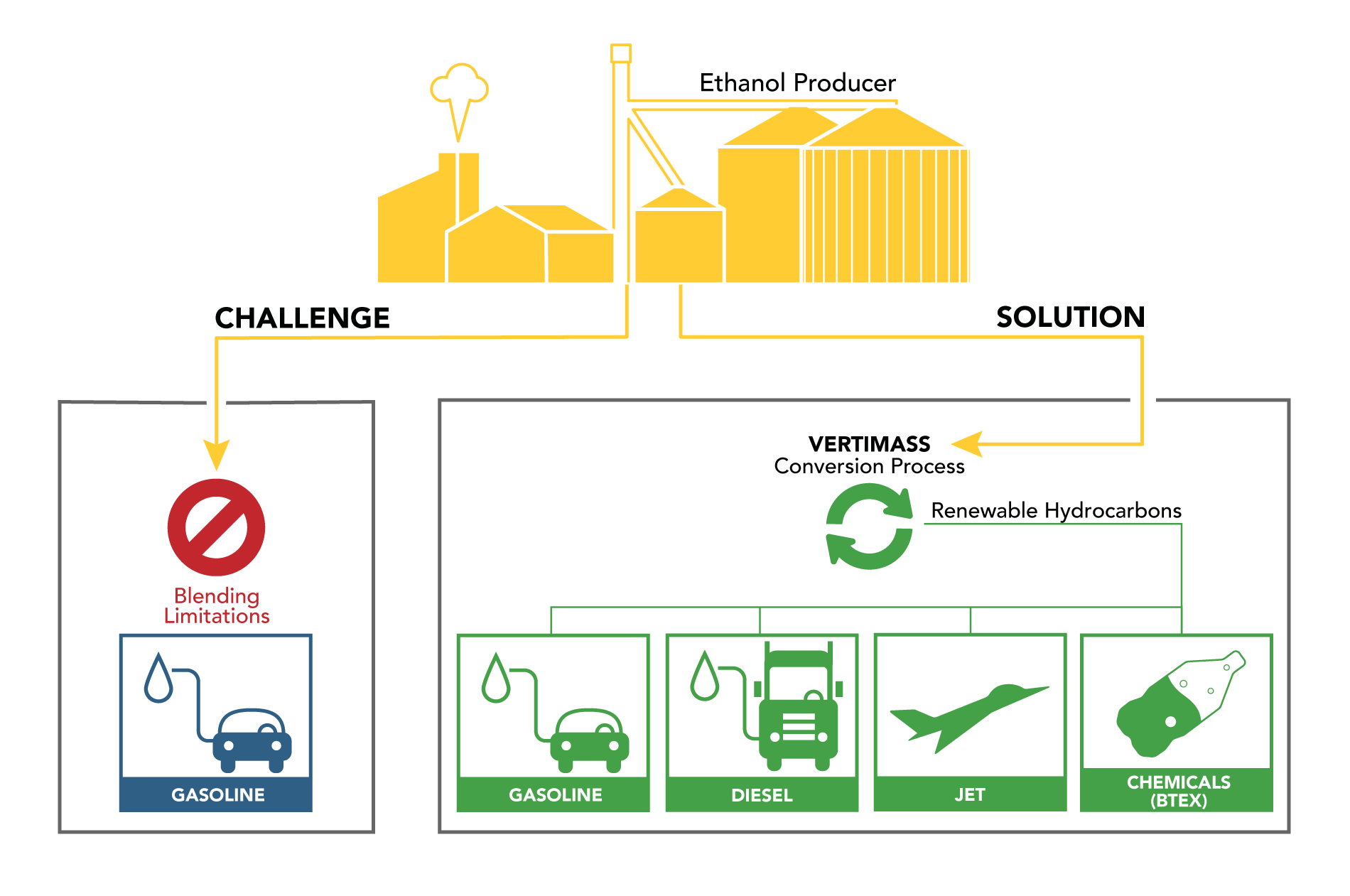

Vertimass Catalyst Technology provides a simple process with resulting low capital and operating costs, that produces the least expensive hydrocarbons from biomass, while simultaneously making benzene, toluene, ethyl benzene, and xylene (BTEX) as a valuable coproduct. In addition, Vertimass Catalyst Technology does not need external hydrogen that other ethanol conversion technologies must rely on, thereby avoiding extra costs and infrastructure challenges that are detrimental to the environment.

Challenges for the Renewable Fuels Industry

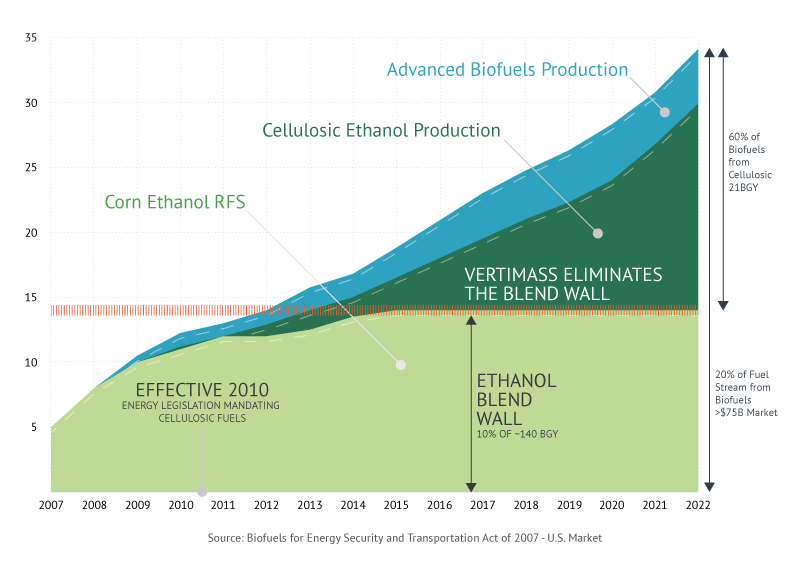

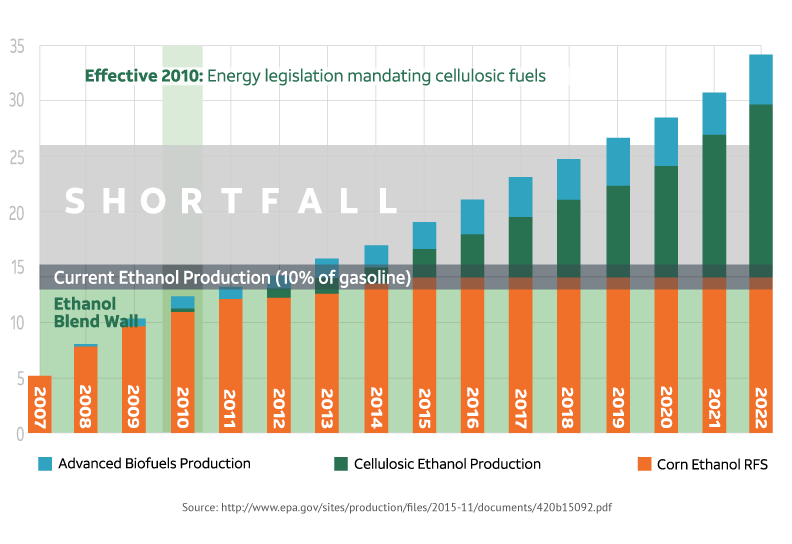

Currently, about 14 billion gallons of corn ethanol is produced annually in the United States, representing 10 percent of the existing 140 billion gallons of blended gasoline used in the US. This quantity corresponds to the maximum blend levels allowed for conventional vehicles, thereby creating a market limit referred to as the "blend wall" that stymies additional US ethanol sales. As a result, reductions in greenhouse gas (GHGs) emissions offered by renewable ethanol are limited while fossil fuels continue to contribute to climate change. Vertimass developed a simple solution to this challenge.

Ethanol Blend Wall and Vertimass Solution

Blend Wall Limits U.S. Gasoline Ethanol Market

Vertimass Solution

Vertimass can eliminate the blend wall by converting current and/or future ethanol into renewable diesel, gasoline, and jet fuel blend stocks. Furthermore, the technology can be deployed in any ethanol plant whether the ethanol is from corn starch, cane sugar, or cellulosic biomass. The resulting hydrocarbons allow ethanol producers to bypass the blend wall. In addition, the catalyst can produce blend stocks for diesel and jet fuels as well as make more valuable chemical precursors. This simple, low-cost operation can be easily bolted onto existing and future plants that produce ethanol from corn starch, cane sugar, or cellulosic biomass.

This Breakthrough Technology:

- Achieves high yields of gasoline, diesel, and jet fuel blend stocks,

- Can produce valuable chemical feedstocks,

- Operates at moderate temperatures and low pressures,

- Can process dilute to concentrated ethanol in water streams,

- Has prolonged catalyst life, and

- Has low capital and operating costs.

- Anhydrous ethanol can be also converted to HCs.

Application of this new catalyst eliminates the ethanol “blend wall” that now limits ethanol markets (10% in gasoline) and opens up new heavy duty diesel, jet fuel and chemical markets.

HIGHLIGHTS

- Low capital and operating costs for Vertimass "bolt-on" to existing and future ethanol production plants.

- Production of renewable fuel blend stocks with significant competitive advantages.

- Elimination of the "blend wall" that now limits ethanol markets.

- Expansion of ethanol sales to new gasoline, diesel fuel and jet fuel markets.

- Conversion of ethanol to valuable chemical precursors.

- Expanded reduction of greenhouse gases.

- Positioned for rapid large-scale production to support the Renewable Fuel Standard.

Featured Articles

Vertimass Partners with Team to Convert Carbon Dioxide into Jet Fuel through Danish Government Award

An investment in Vertimass must be considered speculative. There are no guarantees of distributions or returns, and an investor may lose all or part of their investment. There are various risks related to an investment in Vertimass which are described in the Private Placement Memorandum. These risks include:

- Emerging Growth Company: The Company is an emerging growth company that is not yet profitable, is without significant operating history, and may experience significant losses for some time after the Offering.

- Expectations of Future Losses: The Company is not currently profitable.

- Failure to Achieve Targeted Raise: As discussed above, the Company is seeking to raise up to an additional $45 million for use as working capital through the Offering (the “Targeted Raise”). In the event the Company is unable to raise up to the Targeted Raise, it may not be able to fund its operations as it presently anticipates.

- Illiquid Investment: Members of the Company are not permitted to withdraw their investment from the Company and therefore may have to bear the economic risk of an investment in the Company for a substantial period of time.

- No Assurance of Additional Capital: The success of the Company depends upon receiving significant funding from the net proceeds of this Offering, as well as additional financing.

- No Assurance of Distributions: Members may not receive any cash distributions.

- No Role in Management: Members will be unable to exercise any management functions with respect to the Company. The rights and obligations of the Members are governed by the provisions of applicable Delaware law and by the Operating Agreement.

- Projections: Any projected financial results prepared by the Company have not been independently reviewed, analyzed, or otherwise passed upon. Such “forward looking” statements are based on various assumptions of the Company, which assumptions may prove to be incorrect. There can be no assurance that such projections, assumptions and statements will accurately predict future events or actual performance.

- Changes in Fuel Prices: In recent years, the price of ethanol has been less than the price of petroleum-based fuels, which increased demand for ethanol and other comparably priced alternative fuels. However, the price of ethanol and petroleum-based fuels can drastically change over time so it is difficult to predict how fuel prices will be in the future.